Don’t leave your loved ones without a plan.

Over the course of your lifetime, you will dedicate a significant amount of time to carefully plan for life’s major milestones…

Parenthood

Retirement

Home ownership

College

Birthdays

Career Paths

Vacations

Weddings

But what about the milestone of losing a loved one?

What about planning for when your loved ones lose YOU?

Should your commitment to planning for your loved ones end when you're no longer here?

The answer is no.

And, most of us already understand why planning for this milestone is important. You need to have a legal plan to ensure:

Your kids are cared for if the unexpected occurs

Your spouse has financial security when you can no longer provide for them

Your assets go where you want them to, with minimal state interference

Your healthcare wishes are known, even when you can't speak them

BUT IT'S MORE THAN THAT

Estate planning is also about giving your loved ones:

A shield to protect them when facing life’s uncertainties

Peace of mind when they are undergoing emotional stress

A lasting impact, providing comfort and security for generations to come.

So, why don’t you have an estate plan yet?

Believe it or not, if you don’t have a plan in place you aren’t alone! According to a 2023 Caring.com study, only 33% of American have put a plan in place.

This means that 67% of Americans are leaving their estate and the guardianship of their children up to the court, in the event of their death or incapacity.

40% of the survey respondents said they just haven’t gotten around to it

13% said the estate-planning process is too costly

12% said they don’t know how to get a will

WE UNDERSTAND THESE ROADBLOCKS!

But think about it this way…

What happens when you DON’T have an estate plan? 🤔

Here are just some of the challenges your loved ones will face after you are gone:

Financial Challenges

Families will need to handle the deceased's finances: bank accounts, investments, paying bills, and settling debts.

Funeral Arrangements

This can be emotionally overwhelming, especially without clear instructions.

Legal Processes

Navigating complex probate process: identifying and distributing assets, paying debts, and resolving any disputes.

Guardianship for Minor Children

Without a will, intestate laws determine the placement of minor children, which may or may not be what’s best for them.

Estate Taxes

Some estates are subject to estate taxes, which can require financial planning and compliance with tax laws.

Emotional Stress

Now tack on the emotional stress of losing a loved one.

An estate plan will reduce the weight of these burdens.

Real-World Scenarios

When Estate Plans come to life

When Amy’s last surviving parent passed away she found herself feeling profound grief. She remembered the last thing she said to them and thought about all of the life’s big milestones that she would no longer share with them. Then, reality kicked in. She wasn’t sure how to arrange a funeral. How much would it cost? Did she know her mom’s account passwords? What would happen to their family home?

However, an unexpected phone call from her parent’s trustee changed her life. She found out that her parents had a well-prepared estate plan. Not only was the funeral pre-arranged, her mom even arranged for a limo to pick Amy and her siblings up the day of the funeral. All of her accounts will now be managed by the trustee, so Amy doesn’t have to worry about changing the account names over. Her parent’s wishes were expressed in the estate plan and all of the details are already taken care of.

This thoughtful preparation meant that Amy didn't have to worry about the details during this emotional time. She could focus on healing and remembering her parents, forever grateful for the peace of mind their careful planning had provided.

Setting it and Forgetting it

This is a personal story about my grandparents, Lloyd and his wife Louise. They created a basic estate plan early on in their marriage that would divide their estate between their blended family. Half would go to Louise’s son (Clyde) from a previous marriage and the other half would get divided between their 4 children together. At the time, Clyde was an adult and they named him executor.

By the time both Lloyd and Louise had passed away, Clyde was an elderly man. The estate to be divided was a home that was worth $40,000 and was required to go through the probate process. Unfortunately, during this process Clyde fell ill and ended up in hospice. Since he was unable to perform his executor duties, the case (and the $40,000 inheritance) was stuck in the court system for almost 3 years.

My mom had to petition the court to get the executor changed over and in doing so, cost the estate almost $11,000 in legal fees. In the end, Clyde inherited his $20,000 and my mother and her brothers ended up with a little under $2,000.

Even with a modest estate, a little planning ahead of time could have saved my mother’s family a lot in the end.

Why put your loved ones at risk?

You spend your lifetime doing everything in your power to protect and provide for the ones you love.

You're there for them through thick and thin, ensuring their well-being, nurturing their dreams, and safeguarding their future.

Should your commitment to protect them change once you’re gone?

You have the power now to make a difference for them later.

Smart Estate Planning for Modern Lives

I’m Jayme, your estate planning attorney. At Cherish Legal we offer estate planning that is simple, easy, and can be done 100% remotely - when it fits your busy schedule! We remove the estate planning roadblocks to make protecting your loved ones the real priority.

I will make sure that your loved ones are taken care of when they need it the most.

What can you expect when you work with us?

A customized plan, tailored for you without having to coordinate schedules, or leave your couch.

Your specific legal questions addressed by your attorney. We are here for you every step of the way, with no hourly fees.

A simple and efficient process that was created with you in mind. We’ve crafted every step to take out the guesswork and ensure a seamless experience.

Resting easy, knowing you've prepared for every worst-case scenario and that your loved ones are fully protected, no matter what the future holds.

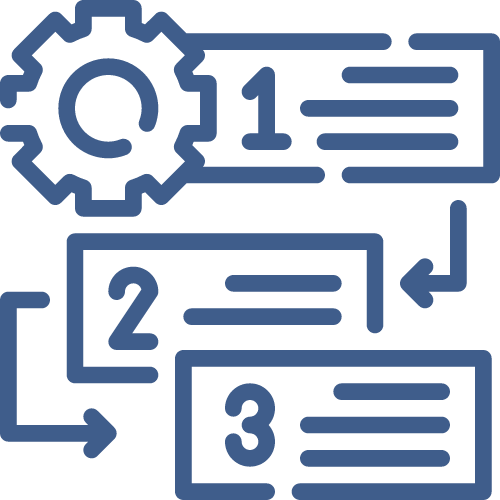

How it works

Choose a Plan

Schedule a 15-min consultation with our attorney to ensure you are selecting the plan that fits your needs.

Craft Your Plan

Craft your perfect estate plan using our user-friendly, step-by-step virtual estate planning process.

Rest Easy

Rest easy knowing you have an estate plan that you actually understand and that accounts for all your worst-case scenarios.

How to get started with us

Schedule Your Consultation

We need to understand your personal situation and what your goals are in order to know whether it’s best for you to use a will or a trust for your estate planning.

Estate Plans for Individuals

Essential Plan

will-based Plan

$800

initial fee

$120/month*

after 3 months

Enhanced Plan

Trust-Based Plan

$1600

initial fee

$200/month**

after 4 months

*On average, our Essential Plan takes 2-3 months to complete. The monthly retainer is only charged if you have not signed your documents after 3 months.

**On average, our Enhanced Plan takes 3-4 months to complete. The monthly retainer is only charged if you have not funded your trust after 4 months.

Joint Estate Plans for Married Couples

Essential Plan

Will-Based PLan

$1500

initial fee

$150/month*

after 3 months

Enhanced Plan

Joint-Trust Plan

$2500

initial fee

$250/month**

after 4 months

*On average, our Essential Plan takes 2-3 months to complete. The monthly retainer is only charged if you have not signed your documents after 3 months.

**On average, our Enhanced Plan takes 3-4 months to complete. The monthly retainer is only charged if you have not funded your trust after 4 months.

Need More Help?

Contact Our Office

For questions about our firm, our estate planning process, or for immediate assistance, please email us at jayme@cherishlegal.com. We are open from Monday-Thursday 9am-4pm to respond to your message.

Hi! I’m Jayme.

Founder of Cherish Legal and virtual estate planning attorney. If you've met me or worked with me, you might already know I like to break from tradition. Well, I'm here to revolutionize estate planning just for you!

Many of my clients have said that meeting with an estate planning attorney just doesn't fit their busy schedule. I’m introducing an innovative, client-centric estate planning process that’s unconventional, but designed for your convenience. When you join our community, you're more than just a client: you're a valued member. And, I believe you deserve a better way to plan your legacy.

Over the course of this experience, my clients will walk away with an estate plan that they actually understand and that will actually work when the time comes.